Forecast for the first quarter of 2025

Guarantee

101,5 billion soums

Compensation

22,5 billion soums

Service mortgage

86,6 billion soums

Share contribution

28 billion soums

Resource allocation

91 billion soums

Total

694 billion soums

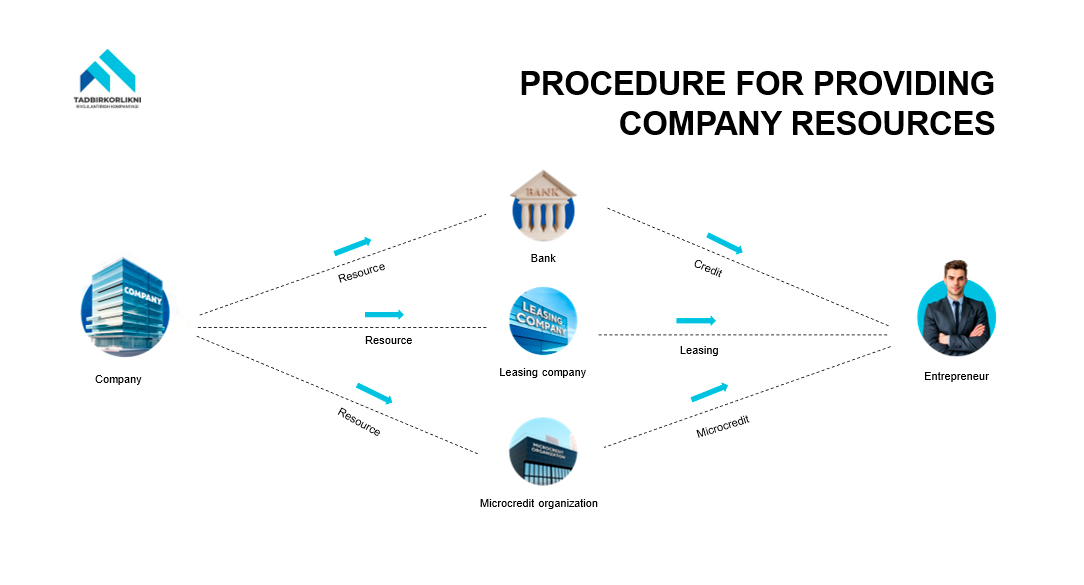

Resource provision

Resource provision – loan funds provided by the Company to commercial banks, leasing and microfinance organizations for the purpose of financing projects of small and medium-sized businesses entities and self-employed individuals.

Requirements for partner organizations to provide resources:

- Registered and operates on the territory of the Republic of Uzbekistan;

- Are not in liquidation, no insolvency proceedings have been initiated against them;

- As of the date of submission of the application, there were no overdue debts on loans (leasing, bank guarantee, letter of credit) and taxes (except for commercial banks);

- Previously, there were no debts that went to court (except for commercial banks);

- Bad (“C” and below) credit history and no negative history of Company assistance;

- According to the financial results for the last two reporting years, the activity did not end at a loss;

- Microfinance and leasing organizations have been created and have been operating for at least 2 years and the size of the formed authorized capital is more than 5 billion soums;

- According to data published by the Central Bank, the NPL rate did not exceed 5 (five) percent in commercial banks and 2 (two) percent in microfinance organizations;

- According to information provided by leasing organizations, the rate of NPL did not exceed 2 (two) percent;

- There is no debt on card No. 2 (except for commercial banks);

- 90% of bank account turnovers of leasing organizations were leasing operations;

- Commercial banks had a “stable” rating from international rating agencies;

- The capital adequacy ratio of a microfinance organization is at least 10%, and the liquidity ratio is at least 100%;

- The total size of all major risks of a microfinance organization (risks associated with one borrower or a group of interrelated borrowers, the total amount of which is 10% or more of the organization’s private capital) did not exceed 5 times the size of the microfinance organization’s private capital.

Areas for which resources are not provided:

- Production of alcohol and tobacco products and (or) organization of their trade activities;

- Organizing and conducting wholesale trade;

- Buildings and equipment of wholesale trade, public catering facilities and separately organized filling stations (except for trade and service facilities, roadside infrastructure facilities, including for refueling cars as part of the complex and organization of activities of retail outlets used for powering “green” technologies, including electric cars);

- Repayment of a previously received loan (leasing) or any other debt;

- Organization of insurance company activities;

- Purchase of passenger cars not involved in production of projects in which assistance is provided.

- projects implemented in the agricultural sector (with the exception of buildings and equipment used for storage, processing and packaging of agricultural products).